Written by Emily Cross.

22 minute read

Facing difficult decisions while a loved one is still alive but approaching the end of their life can be emotionally exhausting. While we may need time to come to terms with how life is changing, there are also legal routes and tools that may provide more options than you realise.

As a family-run funeral provider passionate about offering help and support in any way we can, we are always here for you. If you’re looking for practical ways to support a loved one, our guide on how to set up power of attorney can help. This current guide goes a step further, walking you through everything you need to know about what it is, how it works and why it matters.

Although you may find these types of discussions difficult, especially when you are bracing yourself because you may soon have to find a way to cope with the death of a parent or any loved one, our resources are always here to help you.

Key takeaways:

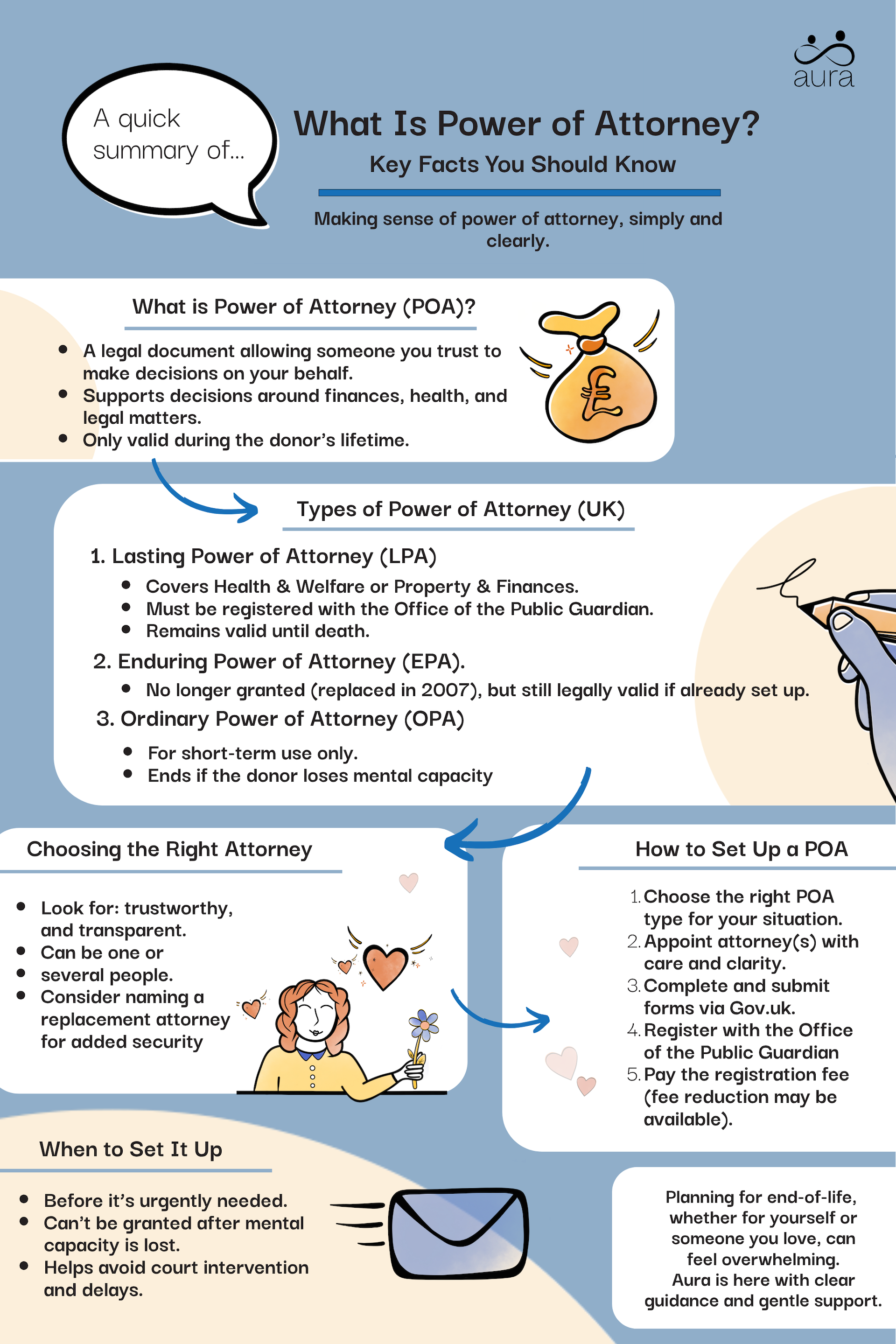

Power of Attorney (POA) is a legal document that grants someone you trust the legal authority to act on your behalf and in line with your best interests. There are three main types of power of attorney (covered in the next section) and the right one will be dictated by your personal circumstances.

A POA is an important legal power that relatives and loved ones can use to manage your finances, look after your health, and take care of legal matters on your behalf. If you find that you are losing the capacity to take care of these things independently, granting POA to someone you trust may greatly reduce your stress while helping to maintain your quality of life.

The type of power of attorney you choose to put in place will be determined by your individual circumstances. Let’s take a look at the three types:

An LPA covers financial and health decisions for the rest of your life and will automatically cease upon their death. For the LPA to be legally valid, it must be registered with the Office of the Public Guardian. If this is not done, the LPA will not be granted, even if the donor has agreed that they want you as their attorney.

It is important to note that there are two types of LPA. The first is a Health and Welfare LPA, while the second is a Property and Financial Affairs LPA. You may find that careful consideration is needed to determine which one is right for your loved one’s specific case, and that speaking to a solicitor may help. They will be able to provide you with independent expert advice that ensures you know your rights and the scope of any powers you may be granted.

EPAs were replaced by LPAs back in 2007, but those that have already been granted remain valid today. They were typically used to make financial decisions on behalf of a loved one and are still legally binding even though no new EPA will ever be granted again. Much like with LPAs, the specific scope of the power an attorney has under an EPA will be outlined in the legal document used to create it.

OPAs are typically reserved for temporary scenarios, such as when a loved one is incapacitated due to an illness injury that they are expected to make a full recovery from. Because of the temporary nature of OPAs, they become invalid as soon as the donor exhibits any reductions in their mental capacity. There is no legal mechanism for an OPA to be upgraded to an LPA in such cases.

Setting up a power of attorney may sound like a daunting and time-consuming prospect, but it’s something that can be broken down into a series of smaller steps. The first steps are to choose which type of POA you need and to find the right person to act on your behalf.

In many cases, the attorney will be the spouse, civil partner, or next of kin, but there is no legal requirement for this to be the case. Before this can be done, you first need to decide on the POA. EPAs are no longer granted, which leaves you with a choice between LPA and GPA.

If the circumstances requiring a POA look like they will change to the extent that the donor will be able to resume looking after their own affairs, you may wish to consider applying for a GPA. In all other cases, you may find that an LPA is a more suitable option. If you are considering issues such as ongoing financial management, healthcare decisions at difficult times, and possible mental impairment with age, an LPA is what a trained solicitor will typically advise you to consider.

You can have one attorney or several…there is no legal requirement to have only one person acting on your behalf. Here are a couple of things you may wish to consider when deciding how many attorneys should be named:

While the choice is very much a personal one, the attorneys themselves may find that having someone else to talk to may prove beneficial.

Naming your attorney(s) can be an emotional process, as you may feel like you are handing over control in a way you are unfamiliar with. While this is a perfectly natural way to feel about such arrangements, you may find support in reflecting on whether the person(s) nominated possess the following traits:

Sometimes it may be helpful to have several periods of reflection so that you can make choices that the donor, attorney, and the rest of the family all feel comfortable with.

You can get LPA forms online from Gov.uk as well as by connecting with the Office of the Public Guardian. Some families find that contacting a trained solicitor provides peace of mind because they will know that they are dealing with the very latest version of the forms. A solicitor can also guide you through the process at a time when you may already be trying to process a complex series of emotions.

To complete the forms, you will need to provide:

It is important to note that the issue of mental capacity needs to be carefully considered from the point of view of the donor. To this end, a certificate provider who can confirm mental capacity will need to be included for the application to be valid.

The registration process at the Office of the Public Guardian can take up to 10 weeks. We completely understand that this can prove frustrating for those of you who already need to act, and that planning ahead may not always be possible. Unfortunately, there is no express service where you can pay to fast-track the registration, but you can track the application to make sure that you are notified as soon as an issue requiring your attention arises.

Although the POA process may feel daunting right now, you can break it up into smaller steps. One of them is to pay the relevant registration fees so you can proceed with your application—especially helpful when you’re also facing bigger questions like “how much does a funeral cost?”

The standard fee for registering an LPA in the UK is £82 per document, although there are options to apply for an LPA fee reduction depending on your financial circumstances. Because of the complex nature of the fee reduction process, and the fact that guidelines change depending on your individual circumstances, we recommend contacting Gov.uk for personalised help and guidance.

The cost of hiring a solicitor to assist with the application process will vary, but you can expect to pay several hundred pounds for their services. You may find it helpful to contact multiple professionals in your local area and discuss their fees and prices with them on an individual basis.

Others reading this may decide that they feel comfortable enough with the paperwork to embark on a DIY approach. If you fall into this category, you will find that the links to Gov.uk in this guide provide a suitable starting point.

While the way you progress your application is always up to you, it may be worth noting that many families find peace of mind and a sense of reassurance by hiring a professional. A trained solicitor will be able to talk you through everything you need to know while also making sure that your application is granted in the quickest possible time.

Using a power of attorney for the first time can feel overwhelming, especially if you are not familiar with this type of legal arrangement. Breaking down the various stages of putting the POA into practice may help clarify your decision-making process.

If you have an LPA that covers property and financial affairs, it will take effect immediately after registration and you do not have to wait until the donor loses mental capacity. Alternatively, you may have an LPA focused on health and welfare, and in this instance, it will only become valid when the donor loses capacity. Just to define that more, mental capacity is considered lost when a person can no longer understand, retain, or weigh up information needed to make a specific decision—or communicate their choice in any clear way.

A key part of the legal documentation will cover these activation conditions, and having a clear understanding of them can help you understand when your role will begin. You may also find that it is helpful to communicate the activation conditions to the wider family so that they also have a clear understanding of when you will be taking over the decision-making side of things.

As the donor, you are legally obligated to act in the donor’s best interests. As well as legal issues that are outlined by the Mental Capacity Act when your loved one is unable to act for themselves, there are also moral issues you may wish to consider. It may prove difficult or stressful if you are acting on behalf of someone close to you, but remembering that you are doing so with the sole aim of helping them may help you come to terms with your new situation.

Many donors begin the process by keeping detailed records so that they can accurately account for all of the financial transactions they are overseeing. This may help reduce the pressure and administrative strain because it allows you to clearly highlight what you have done and show that it fits within the legal remit of the POA.

The legal documents that form the POA will also highlight specific instances where you must consult the donor. You may find that making the rest of the family aware of these situations can help improve transparency and build trust in the process throughout the family.

Some attorneys may find it helpful to give some thought to the common scenarios they are likely to encounter while acting on behalf of the donor:

Taking some time to remind yourself that you are not taking over the donor’s life, but simply acting in their best interests now that they are unable to do so may help you process how you feel. It is natural to feel caught in two minds when you both want your loved one to be okay and you do not want to do anything that may upset other members of the family. Taking your time to sit with your feelings and talk things through with a close friend or relative may help provide the support you need at this challenging time.

There may never feel like a ‘perfect’ or ‘right’ time to set up a power of attorney, but in many cases, you may find that delaying things only makes it more difficult. As well as the emotions involved, the health and well-being of your loved one may be deteriorating in such a way that you can only make a real difference to their quality of life when you have POA.

While we respect the fact that you will make the decision on when to set up a POA at your own pace, here are some things you may wish to consider:

Setting up a POA before it becomes urgently needed may help reduce the stress of having to tackle a complex part of the legal system at a challenging time. Life is unpredictable and often presents us with situations and challenges we never could have expected. Planning for the future, as far as practically possible, may help you to manage stressful and uncertain times in your life.

Here are some things you may wish to consider as part of a wider approach to planning for the future:

Although it may not be possible to plan for every possible eventuality, you may find that taking a proactive approach helps you reduce your stress and anxiety at this time.

One of the biggest issues families face is that POA cannot be set up after the donor has lost mental capacity. This is so that the best interests of the donor are always protected and that they are suitably looked after. The problem is that much like dying without a will passes key decisions from the family to the legal system, so too does failing to have POA in place. For this reason, you may wish to be as proactive as practically possible so as to avoid financial and emotional strain.

In the case where POA is needed but mental capacity means it cannot be granted, a court-appointed deputy will typically be provided. While this can help make decisions and take action, you and the wider family may feel like the deputy doesn’t understand your specific circumstances or what you know of the donor’s wishes. This may end up adding to the emotional weight you are currently trying to carry.

It can take up to 10 weeks for your POA to be fully registered and legally active, and there are a number of possible sources of delay. By far and away the most common are incomplete forms, forms submitted that contain errors, and inaccurate information. For this reason, you may wish to consider hiring the services of a trained solicitor to ensure that nothing is missed or overlooked.

Provided the donor retains mental capacity, they have the right to change an LPA at any point in the future. If you find you need to do this, the best course of action is to contact all of the relevant parties (attorney(s), OPG, and the wider family) in writing. You may wish to hire a solicitor to help draft a letter so that your wishes are made clear and that there is no uncertainty as to what form the LPA will take in the new arrangement.

Transparency is key here, so making sure that the reasons for the changes are clearly outlined can help ensure that everyone involved is on board. Even though a donor with mental capacity has the right to act unilaterally, changes of this nature often benefit from a conciliatory approach, especially when dealing with sensitive matters amongst close family.

We hope that you have found some words of comfort, perhaps even support, during the course of reading our guide. Facing the prospect of losing a loved one is never an easy process, and it’s one we each come to terms with in our own way and very much at our own pace.

If you find that you need to make decisions on their behalf before they die, you may wish to consider applying for power of attorney as outlined above. And if you want guidance on what to do when someone dies, we have resources that can help with that too.

We’re also available to provide support with prepaid funeral plans while your loved one is still alive, as well as our direct cremation service that you may find helps as well. Please feel free to reach out to our kind and compassionate team whenever you feel ready.

If you have any questions, would like a brochure or simply would like a chat through our services, our award-winning team is here to help.

Unlike other providers, we won’t hassle you with constant calls. We’ll simply ensure you have the information you need and leave you to come to a decision in your own time. When you’re ready for us, our team will be ready to help.

Power of attorney is a legally recognised document that allows the donor to grant someone else the status of attorney. You will also sometimes see ‘attorney’ used interchangeably with ‘agent’ when searching for advice and guidance online.

The attorney is legally allowed to act on behalf of the donor so that they can further their interests. This covers things such as financial matters, healthcare decisions, and a variety of other practical considerations, such as living arrangements. The legal document that is created by the donor will outline the specific areas in which the attorney is allowed to act and will describe in detail the powers that they have.

You may find that consulting a local solicitor is less stressful than attempting to fill out the requisite forms yourself. While, in principle, anyone can complete the required paperwork, having a legal professional check everything over once they have guided you through the process may provide additional peace of mind. You may also find that you can ask them anything you are unsure of or worried about, including the specific scope of the powers in a given area.

There are three different types of power of attorney: Lasting Power of Attorney (LPA), Enduring Power of Attorney (EPA), and Ordinary Power of Attorney (OPA). An LPA is the most frequently used arrangement and it can cover things such as health, welfare, living arrangements, and financial considerations. The specific scope of the powers will need to be outlined in the legal document. EPAs are no longer granted and have been replaced by LPAs, although an EPA that was granted before 2007 will remain valid and legally applicable today. An OPA is typically used for a temporary situation and will be automatically revoked upon loss of mental capacity.

Yes, power of attorney can be cancelled or revoked by the donor, provided they have the mental capacity to do so. A deed of revocation — a formal written letter — is typically sent to the attorney as they will need a written record of the fact that they are no longer able to act on the donor’s behalf. You may wish to consult a local solicitor to help you create such a letter in line with best practices.

To be appointed as an attorney for a loved one or relative you have to be 18 or older, have clear mental capacity, and be someone the donor believes will act with their best interests at heart. If you are being granted powers over property and financial matters under an LPA arrangement, you must not have been declared bankrupt otherwise you will be disqualified from acting as attorney.

Power of attorney exists solely while your loved one is alive and therefore is automatically terminated at the point they die. Once the death has been registered, any executors named in the will are in control of administering the estate and redistributing any money, property, and valuables that it may contain. If there is no will, this is referred to as ‘dying intestate’ and the rules of intestacy will determine who the next of kin is. At no point will your previous status as an attorney influence these matters.

This will depend on the specific powers that the attorney has been granted within the legal document. Commonly granted powers include the right to pay bills, settle financial matters, and enact financial plans. Healthcare decisions are also commonly included, as is the right to decide where the loved one lives and what medication they should take to help maintain and improve their current state of health.

The Court of Protection allows you to object to the initial registration and to object to the subsequent actions of the attorney. Objections can be made on factual grounds (a divorce has occurred, the donor has died, or the attorney has died) as well as prescribed grounds (fraud has occurred or there are issues around lack of mental capacity) and you may find consulting a solicitor helps you to outline your case.

staging site last replicated: MISSINGNO.